Table of Content

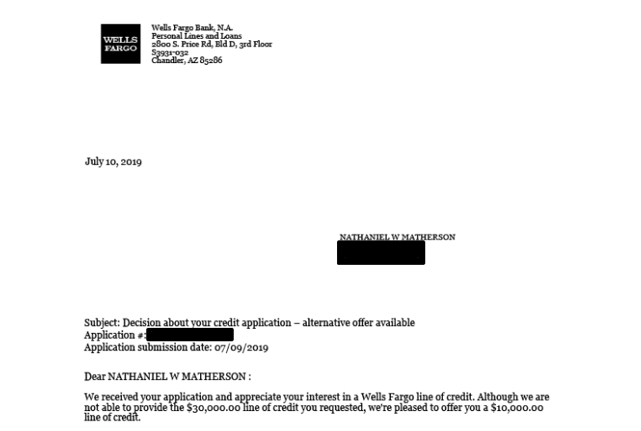

Used Bathfitters for a shower install, they led us to believe it was an installment loan financing from Wells Fargo. Got approved and then they ended up sending a credit card and it reports to the credit bureau as revolving credit. Reached out the salesperson who told us it was an installment loan and asked him why the credit card was sent, he told us not to use it and we wouldn't be charged interest. STAY AWAY from this Wells Fargo scam, the interest rate is ridiculous..we were told it was 0% intro, that's not what the paperwork says. Your mobile carrier’s message and data rates may apply.

A card with Wells Fargo means access to one of the largest banking networks and robust technology. A wide selection of credit cards and the Wells Fargo Rewards program can take your spending a long way. Now that financing is much easier and more convenient. For this Wells Fargo credit card program can be really helpful to make instant purchase with flexible financing options.

Calculating your approval odds

You can use your Wells Fargo credit card anywhere Visa and American Express are accepted. The majority of Wells Fargo’s credit cards are Visa, which is the second largest credit card network globally. In the U.S. only, there are more than 10.7 million merchants accepting Visa card payments. Money paid by, or on behalf of, the borrower in connection with the closing of a mortgage loan.

Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions. When comparing to other rewards programs, Wells Fargo Rewards are a bit different. Unlike Chase Ultimate Rewards or American Express Membership Rewards, points aren’t transferable to airline loyalty programs. This is often the best way to increase the value of rewards points, putting Wells Fargo Rewards at an immediate disadvantage.

Additional Reflect Credit Card FAQs

Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe. Although Wells Fargo Rewards generally have a fixed value, Wells Fargo encourages loyalty with some unique features and experiences.

The business provides services and financing options for the customers. On the other hand, the customer can make the home improvement work so fast and quick with the home improvement company’s assistance. Here are some features of the Wells Fargo credit card. Get up to $600 of cell phone protection against damage or theft when you pay your monthly cell phone bill with your eligible Wells Fargo card (subject to a $25 deductible).

Simple online application

General examples include but are not limited to an origination charge, discount points, and fees for required third-party services, taxes, and government recording fees. Consolidate debt, pay for home improvements, or make a major purchase. Fixed interest rates and relationship discounts for qualified customers. Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

Your personal information and data are protected with 256-bit encryption. A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience. Stay on top of industry trends and new offers with our weekly newsletter. Enter the Rewards online auction to bid on merchandise using your points.

If you're buying a home, you can contact an insurer for an estimate. The length of time during which you can access funds from your account. Fast forward a year and now I’m ready to finish the project and convert from a swap cooler to a refrigerated A/C, this time with a different contractor, however with the same WF account. Put $0 if you currently don't have a rent or mortgage payment.

Customers of these businesses who want to buy items or services from the store on credit can apply for the card. If they are approved, they can use the card immediately for purchases. Here you’ll find valuable sign-up bonuses, 0% APR offers, cash back rewards and more.

Charges paid to the lender voluntarily by the borrower or seller to permanently reduce the interest rate. One discount point is equal to 1% of the principal amount of the mortgage; however, 1 point will typically reduce the interest rate by less than 1%. You can send anyone with any type of Wells Fargo account a gift of cash using your points. Points can transfer to friends and family if they have access to Wells Fargo Rewards and you even have the option to gift points to charity.

Wells Fargo’s rewards structures don’t come with rotating categories, huge sign-up bonuses or extraordinarily-high rates. Someone who wants to truly maximize their credit card earnings will want to look at rewards cards that give heightened rates in certain areas and reward you with large bonuses for early spending. Similar to their balance transfer offers, Wells gives 0% APR offers on purchases. You can pay off your balance in increments over this time, just try to zero it out before the offer ends. Wells Fargo offers Clover POS Systems, as well as payment and credit card processing. Qualifying balance transfers must be made within 120 days of account opening to qualify for the lower intro fee of 3% or pay up to 5% after ($5 minimum).

No comments:

Post a Comment